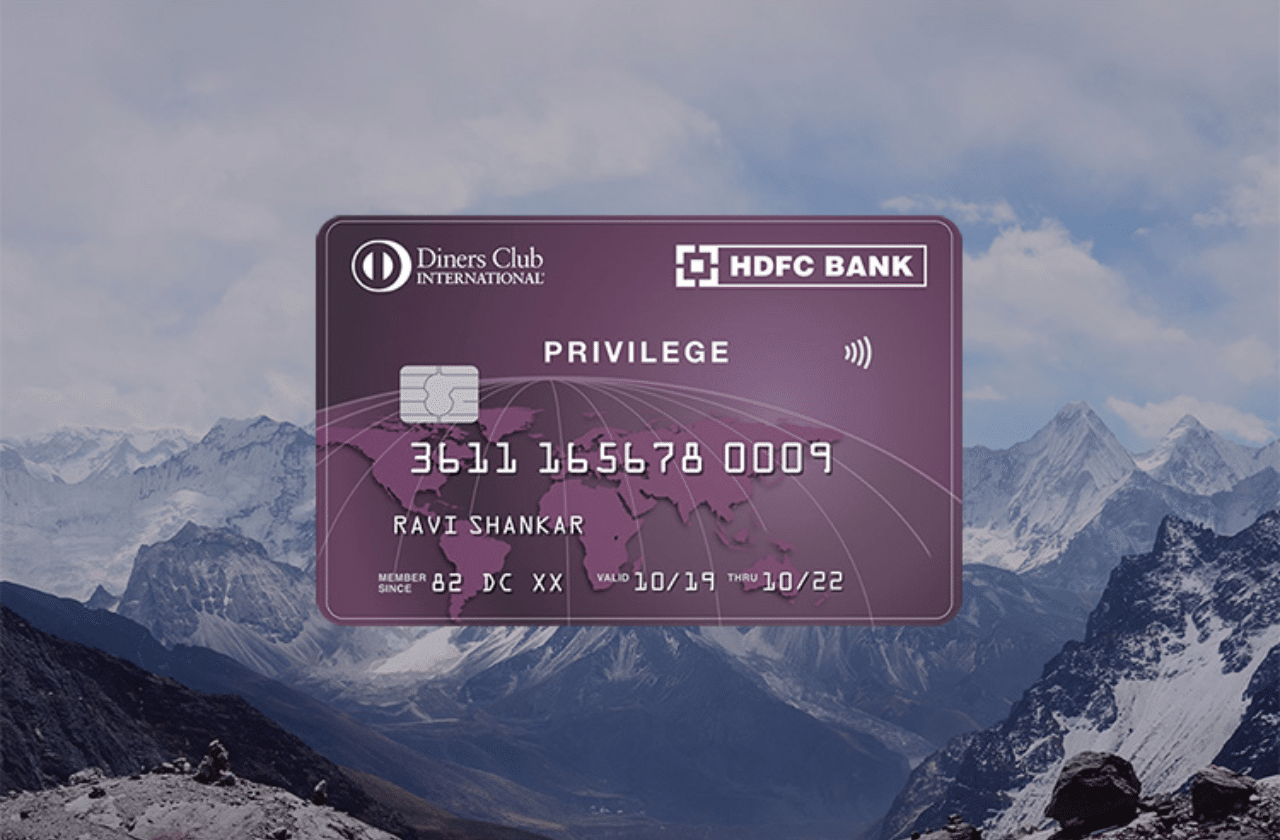

Credit cards have become a vital part of our lives; we use them for practically everything, including shopping, eating, and travel. Diners Club Privilege is one such credit card that provides multiple perks and rewards to its consumers. In this article, we’ll look at the essential features of Diners Club Privilege and how you may make use of them.

Features of Diners Club Privilege Credit Card

Rewards with Diners Club Privilege Card

One of the major benefits of utilizing Diners Club Privilege is the rewards program. You earn 4RPs for every Rs. 150 spent in retail using your credit card. These reward points may be exchanged for a variety of things, including hotel stays, shopping vouchers, and 10X RPs, via the SmartBuy Portal. The more you spend, the more reward points you receive, so it’s a great choice for frequent customers.

Spend-Based Benefits

Diners Club Privilege offers several spend-based benefits to its customers. For example, spending a minimum amount of Rs. 1,50,000 or above on retail per calendar quarter, you can select a Rs. 1,500 voucher from any one of Marriott, O2 Spa, Lakme Salon, Barbeque Nation, or Decathlon. This benefit is unlocked within 48 hrs of achieving the target spend, and the cardholders can redeem the voucher.

Dining Discounts

Diners Club Privilege offers exclusive dining and movie discounts to its customers. With this credit card, you can get 5X (20 RPs) per Rs. 150 spent on Zomato & Swiggy. You can simply unlock this offer by spending a minimum amount of Rs. 150 to be eligible for the reward points.

Travel Benefits with Diners Club Privilege Card

Regular travelers will appreciate the travel perks provided by Diners Club Privilege. You may access over 1000+ lounges throughout the world each calendar year, as well as get travel insurance and flight accident coverage, among other things.

Furthermore, you may earn 2,000 RPs for every transaction on insurance transactions made with your credit card, which can be redeemed for plane tickets and other travel-related expenses. In addition, members will receive 8 free domestic and international lounge access per year with a minimum spend of Rs. 10,000 in the preceding quarter.

Insurance Coverage

Diners Club Privilege also offers insurance coverage on several categories such as Accidental Air Death coverage of Rs. 1 Crore, Medical Emergency Cover worth Rs. 25 Lakhs, Delayed Baggage insurance of Rs. 50,000, and Credit Liability of Rs. 9 lakhs. This coverage provides peace of mind and security to consumers, knowing that they are covered in case of any unexpected situations.

How Diners Club Privilege Credit Card differ from Other Credit Cards?

Diners Club Privilege operates differently from other credit cards. It doesn’t directly sell goods; instead, it offers credit and collection services to its merchant members. This enables cardholders to make purchases on credit at various retailers without previous arrangements. The card is usually used by those travelers who spend money in hotels and restaurants.

Eligibility for HDFC Bank Diners Club Privilege Credit Card

To be eligible for a Privilege card, you need to meet specific eligibility criteria, and they are as follows:

- You must be a citizen of India and be between the ages of 21 and 60.

- You should have a steady income and a good credit score.

- Before approving your credit card application, HDFC Bank considers other factors, such as your employment status and credit history.

Also Read: Top 10 Benefits of HSBC Cashback Credit Card

Conclusion

Diners Club Privilege provides multiple features and perks to its members, making it a great choice for regular credit card users. Whether it’s reward points, perks based on spending, or special deals, this credit card has something for everyone.

Additionally, the wide insurance coverage and travel benefits provide peace of mind and security to clients. If you fit the requirements, then you should consider enrolling for a privilege card and taking advantage of the benefits that come with it.